Marriage tax calculator

Marriage Allowance lets you transfer 1260 of your Personal Allowance to your husband wife or civil partner. While Texas statewide sales tax rate is a relatively modest 625 total sales taxes including county and city taxes of up to 825 are levied.

How To Calculate 2020 Federal Income Withhold Manually With 2019 And Earlier W4 Form

Check your tax withholding with the IRS Tax Withholding Estimator a tool that helps ensure you have the right amount of tax withheld from your paycheck.

. This means that youll pay 186 more if you are married than if you are not. Ad Try Our Free And Simple Tax Refund Calculator. Estimate how much youll owe in federal taxes using your income deductions and credits all in just a few steps with our tax calculator.

This is a utility tool to calculate the marriage cost of your childs dream wedding. Home financial income tax calculator. My Marriage Tax is a trading style of Tax Claim Helpdesk Ltd a company registered in Ireland under registration number 715592.

Use the income tax bracket rate during FY 2022-23 to determine the annual tax bill. Ad 100s of Top Rated Local Professionals Waiting to Help You Today. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

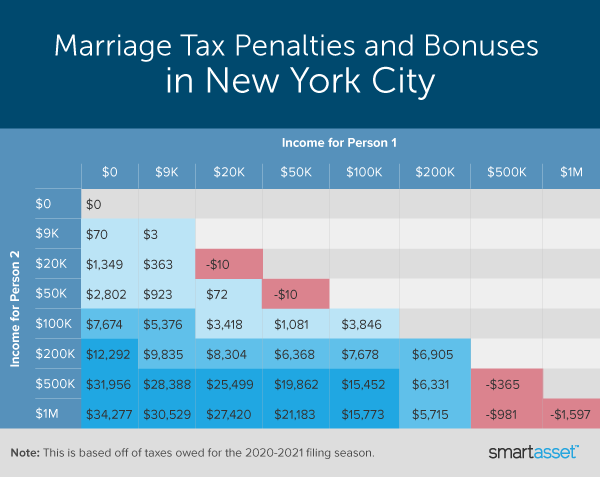

A New Marriage Penalty for High Earning Couplesand a Bonus for Some. Texas Sales Tax. TDS advance tax and self-assessment tax payments made during the fiscal year should be.

That means that your net pay will be 45925 per year or 3827 per month. Marriage Allowance Calculator. Calculate Your Tax Refund For Free And Get Ahead On Filing Your Tax Returns Today.

Discover Helpful Information And Resources On Taxes From AARP. Our income tax calculator calculates your federal state and local taxes based on several key inputs. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

Your average tax rate is. Effective tax rate 172. Conversely the couple receives a.

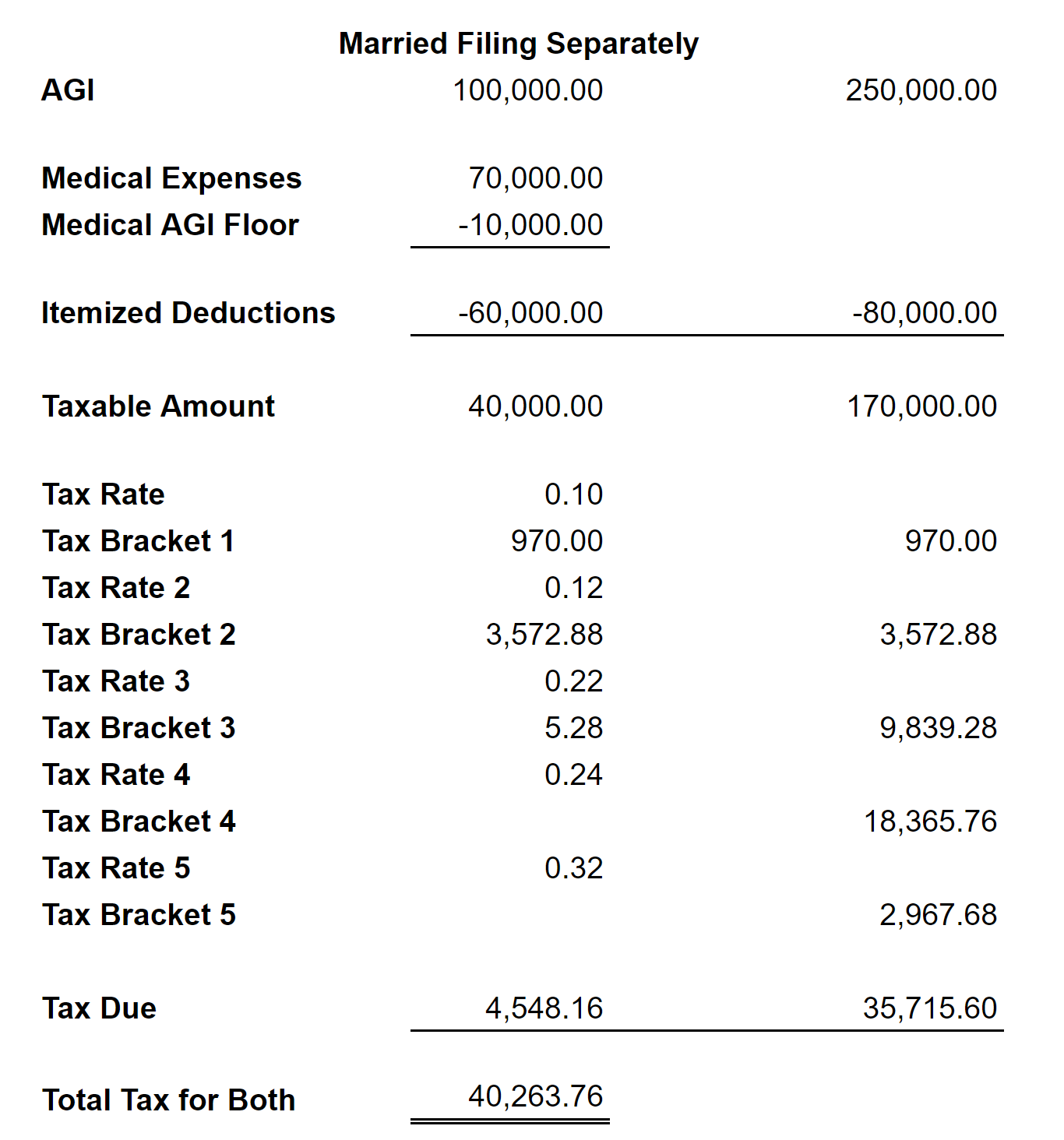

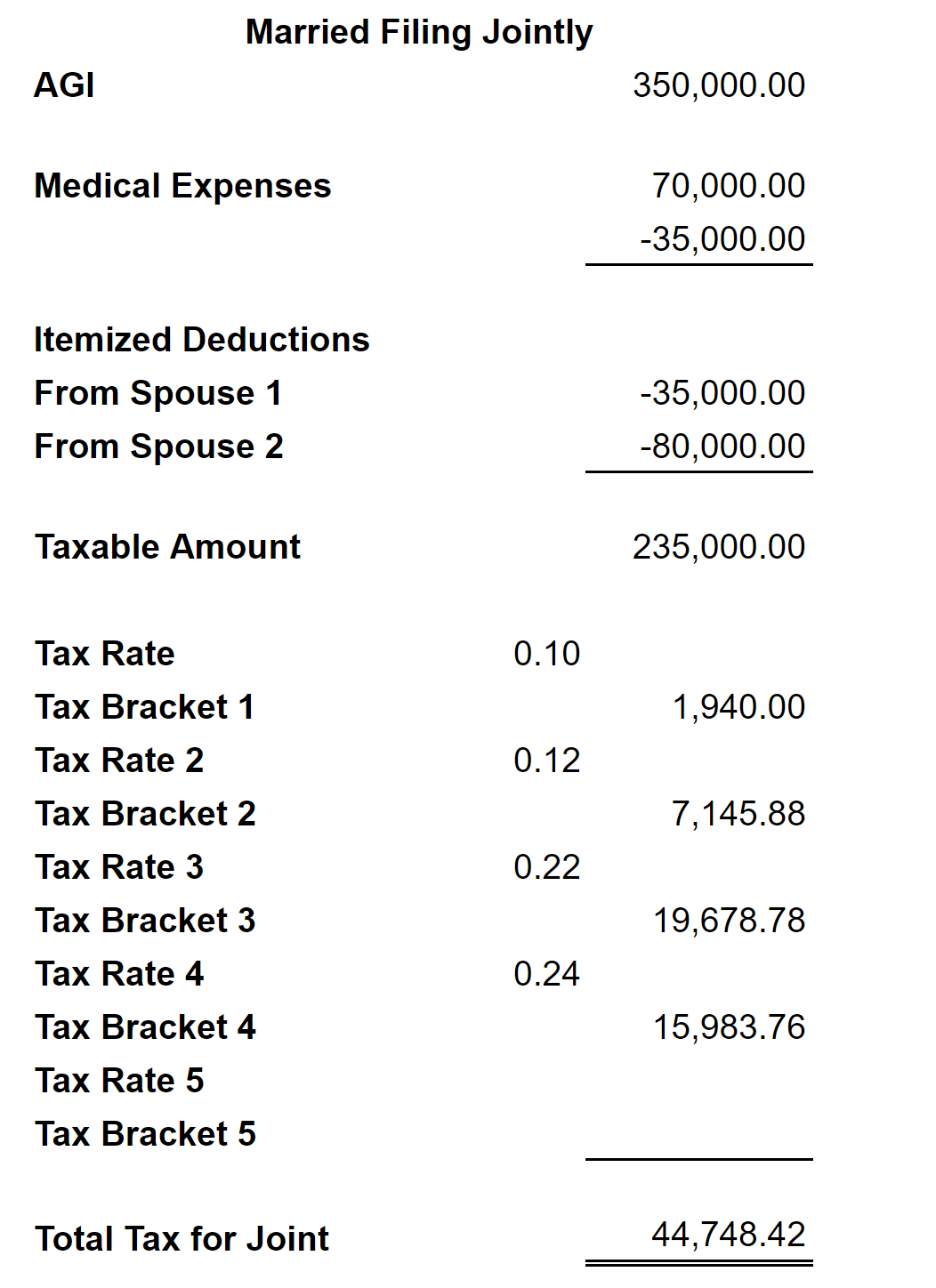

Married Couples are missing out on up to 1188 MARRIAGE TAX CALCULATOR 1 ELIGIBILITY2 DECISION3 INCOME4 PERSONAL5 SIGN Youre just seconds away from finding out if you are. A couple pays a marriage penalty if the partners pay more income tax as a married couple than they would pay as unmarried individuals. Updated to include income tax calculations for 2021 form 1040 and 2022 Estimated form 1040-ES for status Single Married Filing Jointly Married Filing Separately or Head of Household.

100 Accurate Calculations Guaranteed. If you make 55000 a year living in the region of Texas USA you will be taxed 9076. Insurance plan Tax plan.

Compare Tax Preparation Prices and Choose the Right Local Tax Accountants For Your Job. Our new Marriage Bonus and Penalty calculator despite all its Valentines Day finery ignores the new 09 percent. You get an idea of the future expenses for the childs marriage.

By submitting your details. Income Tax Calculate your Married Couples Allowance You can use this calculator to work out if you qualify for Married Couples Allowance and how much you might get. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Your household income location filing status and number of personal. This reduces their tax by up to 252 in the tax year 6 April to 5.

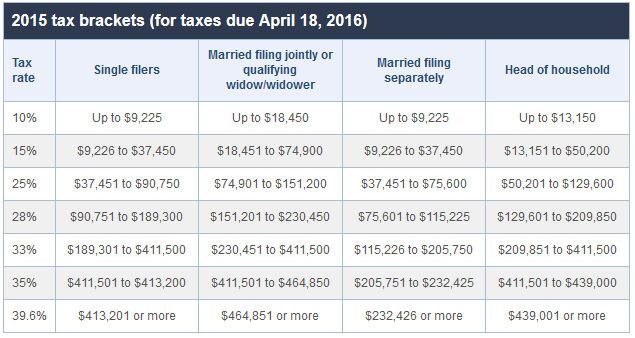

Inkwiry Federal Income Tax Brackets

Marriage Penalty Vs Marriage Bonus How Taxes Work

Understanding Tax Brackets Interactive Income Tax Visualization And Calculator Engaging Data

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Tying The Knot Sometimes Means Paying A Marriage Tax Penalty

How To Calculate Federal Income Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

Income Tax Formula Excel University

Can A Married Person File Taxes Without Their Spouse

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving

Tax Calculator Estimate Your Income Tax For 2022 Free

Taxable Social Security Calculator

Can A Married Person File Taxes Without Their Spouse

What Are Marriage Penalties And Bonuses Tax Policy Center

Income Tax Formula Excel University

Will You Pay More Or Less Taxes When You Get Married Spreadsheetsolving